After dropping 27% over three days, Ether (ETH) price finally reached a bottom at $1,040 on Jan. 22.

The sharp correction liquidated $600 billion worth of future contracts but interestingly, Ether price rebounded to a new all-time high even as Bitcoin price continues to trade in a slight downtrend.

According to Cointelegraph, the increasing TVL and transaction volumes of the decentralized finance sector are behind Ether’s impressive surge.

To determine whether the recent pump reflects a potential local top, we’ll take a closer look at on-chain flows and derivatives data.

Exchange withdrawals point to whale accumulation

Increasing withdrawals from exchanges can be caused by multiple factors, including staking, yield farming, and buyers sending coins to cold storage. Usually, a steady flow of net deposits indicate a willingness to sell in the short-term. On the other hand, net withdrawals are generally related to periods of whale accumulation.

As the above chart shows, on Jan. 23, centralized exchanges recently reached their lowest Ether reserve levels since November 2018.

Although there is some discussion whether part of this Ether exodus is an internal transfer between Bitfinex cold wallets, there has been a clear net withdrawal trend over the past month. Despite these ‘rumors’, the data points towards accumulation.

This data also coincides with the DeFi’s total value locked (TVL) reaching a $26 billion all-time high and signals investors chose to take advantage of the lucrative yield opportunities that exist outside of centralized exchanges.

Futures were overbought

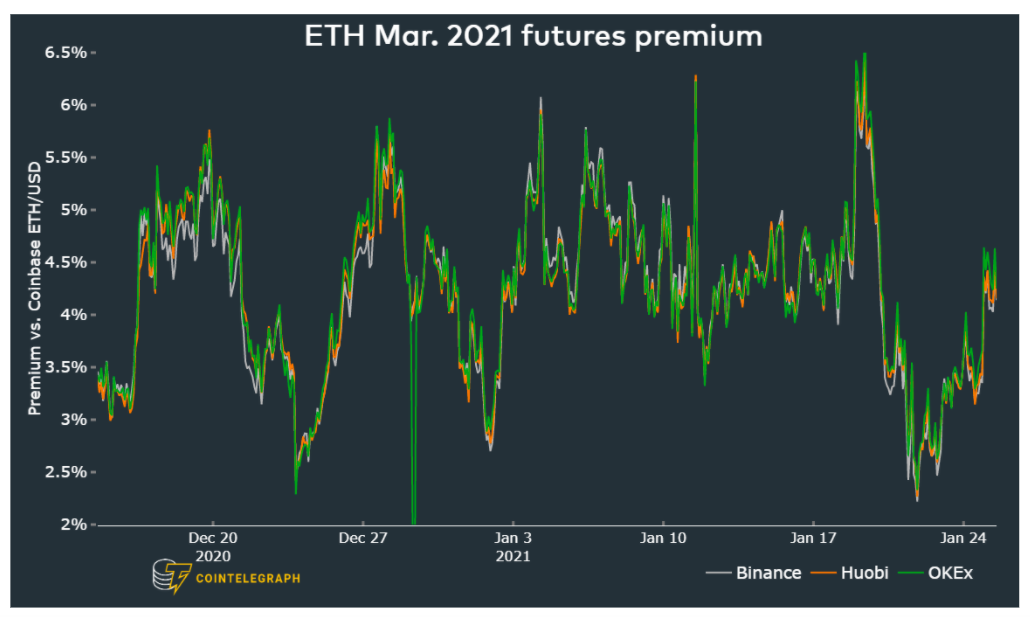

By measuring the expense gap between futures and the regular spot market, a trader can gauge the level of bullishness in the market.

The 3-month futures should usually trade with a 6% to 20% annualized premium (basis) versus regular spot exchanges. Whenever this indicator fades or turns negative, this is an alarming red flag. This situation is known as backwardation and indicates that the market is turning bearish.

On the other hand, a sustainable basis above 20% signals excessive leverage from buyers, creating the potential for massive liquidations and eventual market crashes.

The above chart shows that the premium peaked at 6.5% on Jan. 19, equal to a 38% annualized rate. This level is considered extremely overbought, as traders need an even higher price increase ahead of expiration to profit from it.

Overbought derivatives levels should be considered a yellow flag, although maintaining them for short periods is normal. Traders might momentarily exceed their regular leverage during the rally and later purchase the underlying asset (Ether) to adjust the risk.

One way or another, the market adjusted itself during the Ether price crash, and the futures premium currently stands at a healthy 4.5% level, or 28% annualized.

Spot volume remains strong and traders bought the dip

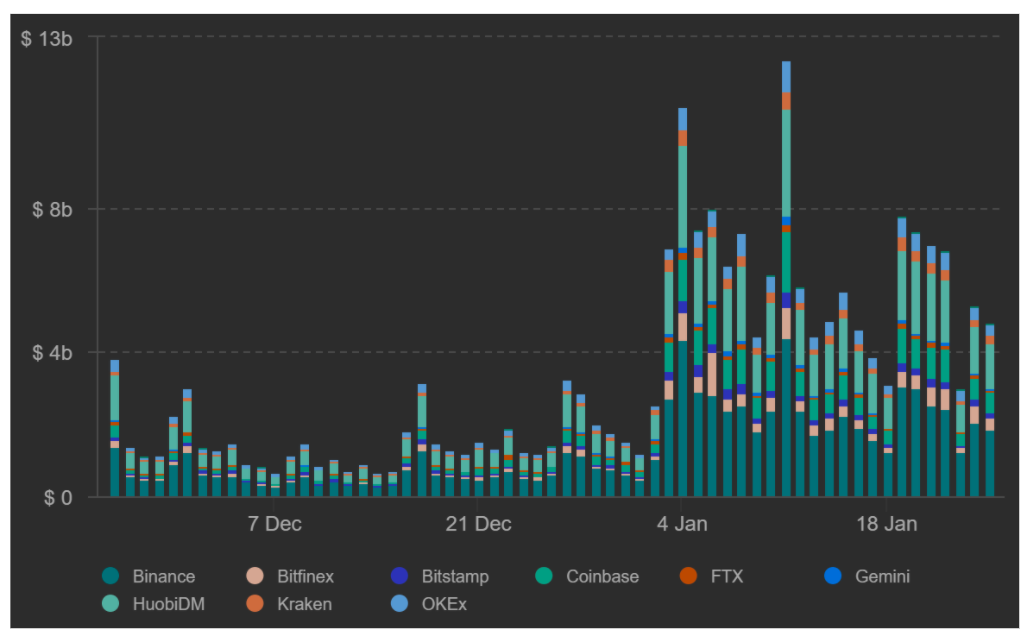

In addition to monitoring futures contracts, profitable traders also track volume in the spot market. Typically, low volumes indicate a lack of confidence. Therefore significant price increases should be accompanied by robust trading activity.

Over the past week, Ether has averaged $6.1 billion in daily volume, and while this figure is far from the $12.3 billion all-time high seen on Jan. 11, it is still 240% higher than December’s. Therefore, the activity supporting the recent $1,477 all-time high is a positive indicator.

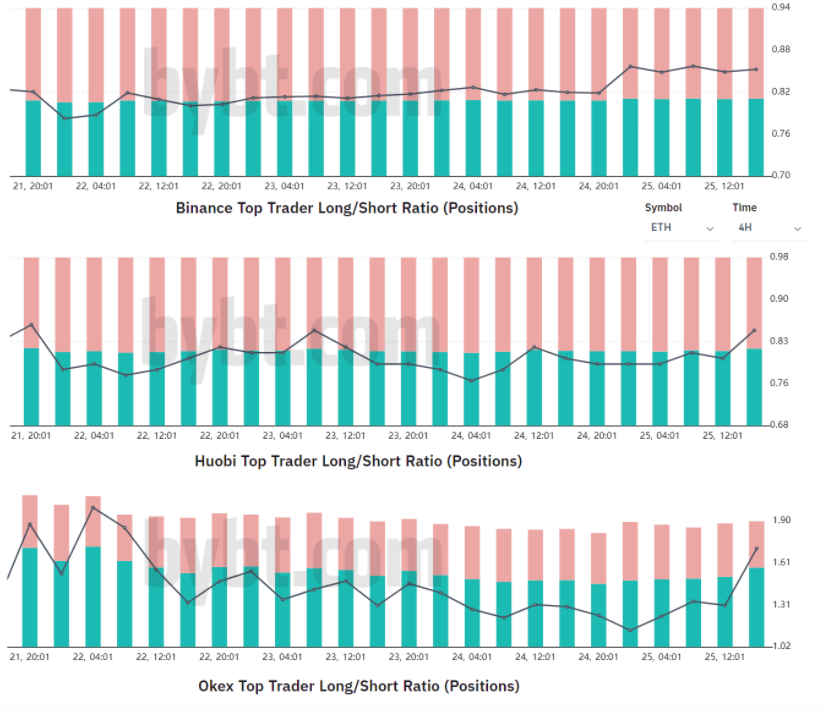

Exchange-provided data highlights traders’ long-to-short net positioning. By analyzing every client’s position on the spot, perpetual and futures contracts, one can obtain a clearer view of whether professional traders are leaning bullish or bearish.

With this said, there are occasional discrepancies in the methodologies between different exchanges so viewers should monitor changes instead of absolute figures.

The top traders index at Binance and Huobi have held roughly the same Ether position over the past couple of days. Huobi’s average over the past 30 days has averaged a 0.83 long-to-short ratio while at Binance traders held a 0.94 average. The current reading at 0.85 indicates a slight negative sentiment.

OKEx stands out as the top traders long-to-short ratio peaked at 2.0, strongly favoring longs in the early hours of Jan. 22, but it decreased until Jan. 24 and finally bottomed at 1.05. The strong net selling trend was reverted today as traders bought the dip and the indicator flipped to 1.17 in favor of longs.

One should keep in mind that arbitrage desks and market makers encompass a vast portion of the exchanges’ top traders metric. The unusually high futures premium would incentivize those clients to create short positions in futures contracts while simultaneously buying Ether spot positions.

Considering Ether’s on-chain data indicating whales hoarding, along with the healthy futures contracts premium, the market structure seems reliable.

The fact that top traders at OKEx also bought today’s dip is further indication that the rally should see continuation.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.