KuCoin (KCS) prices ticked up in the early Wednesday session on July 7, in part because of an ongoing market rally across the top exchange-based utility tokens.

The 72nd-largest cryptocurrency peaked for the day at $14.847 before correcting lower on interim profit-taking sentiment. The move downside accompanied decent volumes, alerting that the sell-off momentum could continue across the European and the U.S. sessions.

At the time of writing, the KCS/USDT exchange rate was approximately $14, up more than 100% on a month-to-date timeframe (MTD).

Therefore, KuCoin’s bearish correction appeared as an attempt to neutralize its overextended upside momentum. The cryptocurrency’s relative strength index (RSI) on one-day charts popped above 70 following its latest price spikes, a reading that technical terms the underlying asset as “overbought.”

The RSI continues to float above 70, alerting about KuCoin interim downside risks before it attempts to break above the technical resistance around $15 (as shown in the chart above).

Bullish setup

Conversely, the price breaking out of a descending channel range to the upside raised its prospects of extending the bullish move further higher. As the charts below illustrate, KCS trended lower while fluctuating inside a falling range—this pattern appears like a Falling Wedge

Falling Wedges are bullish reversal patterns. They come into the picture when an asset’s price action forms a conical shape while sloping down and forming at least two reaction highs and lows. Adjusting the KCS/USDT’s lower trendline move makes a similar descending structure.

Falling Wedge breakouts are technically skewed to the upside. Therefore, KuCoin’s latest resistance break, coupled with a spike in volumes, can be called a bullish breakout, with its profit target lurking near $19.751 (situated as far as the maximum Wedge height).

Fundamentals

KCS’s upside move, on the whole, appeared as a part of an overall price rebound across the exchange token markets.

Nonetheless, KCS markets showed strikingly lesser volumes in the previous 24 hours compared to its exchange-token rivals. For instance, the second-to-worst volume logged by an exchange token was roughly $620,000 (see Unus Sed Leo in the chart above). On the other hand, KuCoin’s 24-hour adjusted volume was $63,531.

Thin volumes mean that there were fewer numbers of KCS tokens trading. In turn, there was a lower KCS liquidity across the markets. As a result, an asset’s price volatility rises in a low volume market and makes it susceptible to the wilder upside and downside moves.

The popular analogy serves as additional headwinds for KuCoin bulls as they attempt to claim the Falling Wedge’s profit target.

KuCoin Shares, or KCS, serves as a utility token on the KuCoin exchange. The platform uses KCS to reward users for using its services, similar to how Binance deploys BNB as a measure to offer users discounts on trading fees. Holders of KCS, meanwhile, also receive a daily dividend, i.e., a KuCoin bonus, which equals 50% of the trading fees on the exchange.

As KuCoin moves to become a fully decentralized platform, it plans to use KCS for transaction fees. The exchange also intends to buy back and destroy half of KCS’s 100 million supply cap. The funds to facilitate the buyback, again, comes from KuCoin’s trading fees.

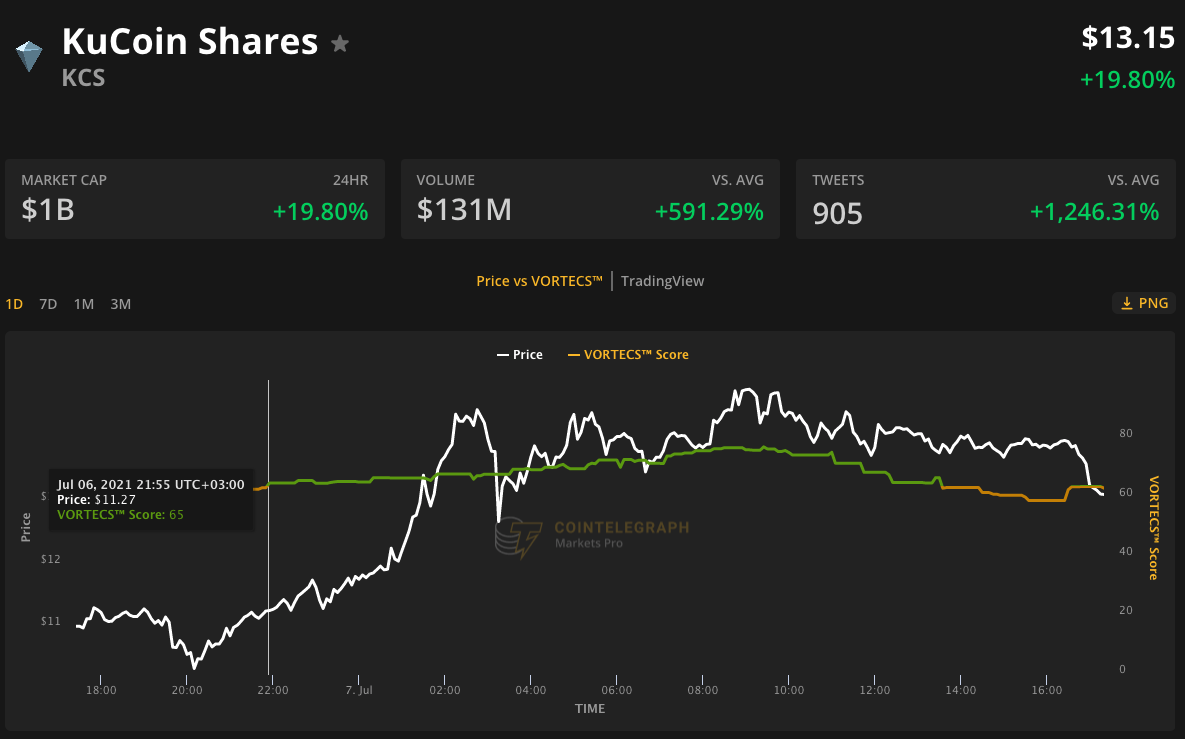

VORTECS™ data from Cointelegraph Markets Pro also began to detect a bullish outlook for KuCoin Shares price hours ahead of the July 7 rally.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen in the chart above, the VORTECS™ Score flashed green on July 6, 21:55 UTC, with a score of 65 with the price continuing to climb higher above $11.27. KuCoin-related tweet volume queries also surged by 1,246.31% over the past 24 hours.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.