Bitcoin (BTC) hodlers have capitulated more than at almost any point in Bitcoin’s history this month.

Data from on-chain analytics firm Glassnode confirms that the November 2022 BTC sell-off was the fourth-largest ever.

Bitcoin investors see multi-billion-dollar losses

In the latest edition of its weekly newsletter, “The Week On-Chain,” Glassnode got to grips with the impact of the FTX debacle on BTC investors.

The results have been mixed, it reveals, with a major loss of confidence, on one hand, triggering loss-making divestment of funds, while “strong accumulation” has also occurred.

For those entering BTC in current conditions, however, life has been anything but easy.

“One consistent event which motivates the transition from a bear back towards a bull market is the dramatic realization of losses, as investors give up and capitulate at scale,” Glassnode explained.

“November has seen the fourth largest capitulation event on record, recording a 7-day realized loss of -$10.16B. This is 4.0x larger than the peak in Dec 2018, and 2.2x larger than March 2020.”

While the dollar-value capitulation can be explained thanks to BTC/USD trading five times higher than in late 2018 and 4.5 times higher than in March 2020, it is no secret that cold feet have characterized crypto markets since FTX imploded.

As Cointelegraph reported, directly following the event, hodlers were sitting on 50% of the BTC supply at an unrealized loss.

Glassnode referenced Bitcoin’s adjusted market-value-to-realized-value (MVRV) ratio, which shows that coins moving on-chain are returning loss-making levels rarely seen before in what it calls “peak under-performance.”

Adjusted MVRV ratio is the relationship between the market value of BTC and its realized value, minus the profit impact of coins dormant for seven years or longer.

“This metric is currently returning a value of 0.63 (average unrealized loss of 37%), which is very significant since only 1.57% of trading days in bitcoin history have recorded a lower Adjusted MVRV value,” the newsletter stated.

“In other words, if we discount profit held across the presumably lost supply, the current market is the most underwater it has been since the near pico-bottom set in Dec 2018 and Jan 2015.”

Buying the dip like it’s December 2018

“The Week On-Chain” nonetheless contains some good news for market participants.

Related: Bitcoin shrugs off BlockFi, China protests as BTC price holds $16K

Despite the previous losses, hodlers have been accumulating BTC aggressively since — and the trend is encompassing everyone, from the smallest “shrimps” to the largest whales.

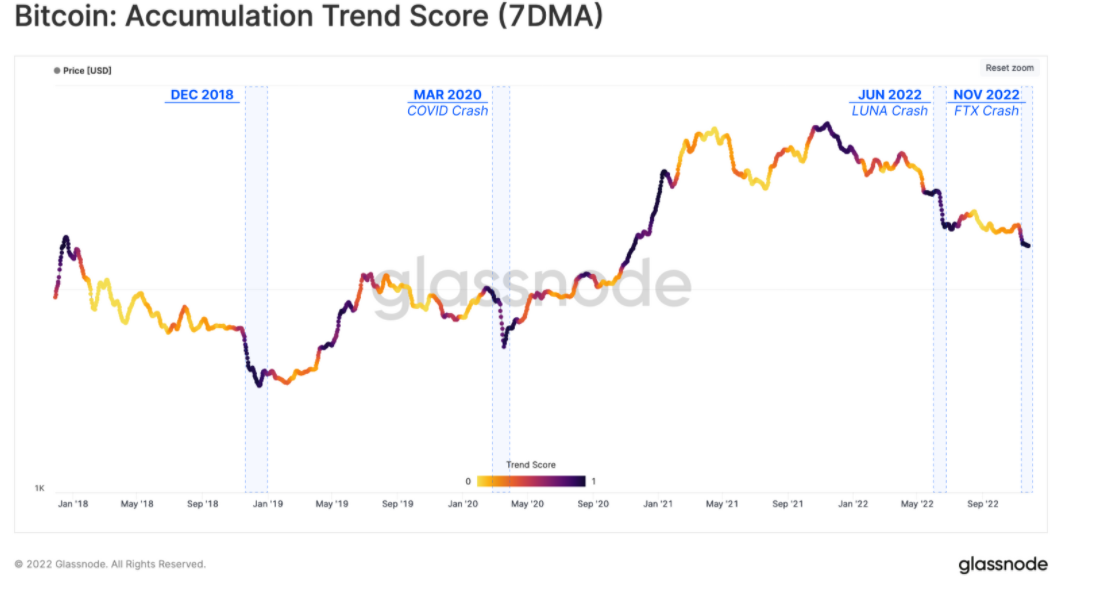

“From a comparative point of view, the recent strong accumulation score following the recent sell-off resembles that of late 2018,” Glassnode stated.

It added that similar black swan events in Bitcoin’s past, including recent ones such as the collapse of Terra’s LUNA, sparked similar investor reactions.

An accompanying chart, the seven-day moving average (MA) of the Accumulation Trend Score, showed current conditions as purple — characteristic of mass accumulation. Yellow, conversely, points to mass distribution of BTC on the market.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.