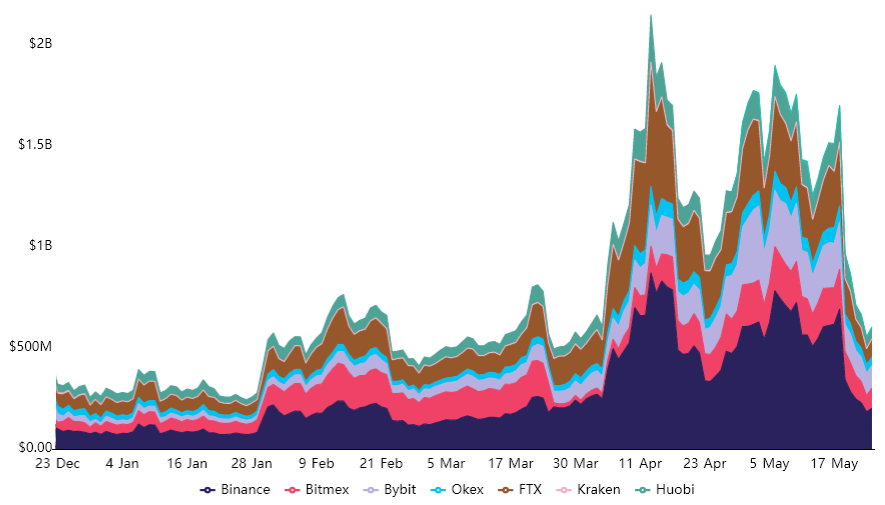

XRP’s price soared 260% in April, moving from $0.57 on March 31 to $1.97 on April 14, its highest level since January 2018. The move caused XRP futures to reach an impressive $2.1 billion in open interest.

However, on Wednesday, as cryptocurrency markets collapsed, XRP lost 60% in four days, liquidating $510 million of long positions. The futures open interest retraced to $550 million, roughly the same level from early February when the altcoin traded near $0.40.

Investors are now questioning whether XRP futures will ever be able to recover to a multi-billion-dollar market. Were April’s figures inflated by excessive leverage, or is it just a matter of time until it rebounds to previous levels?

To understand if the $2.1-billion futures market was an anomaly, one needed to analyze volumes and, more importantly, their premium. This indicator measures the price gap between the futures contract prices and the regular spot market.

If some unprecedented bullishness was set in place, there’s a good chance that futures open interest will take months to regain the impressive levels seen previously. Not only would traders’ confidence take longer to recover, but an exaggerated premium could have been inflating the derivatives markets.

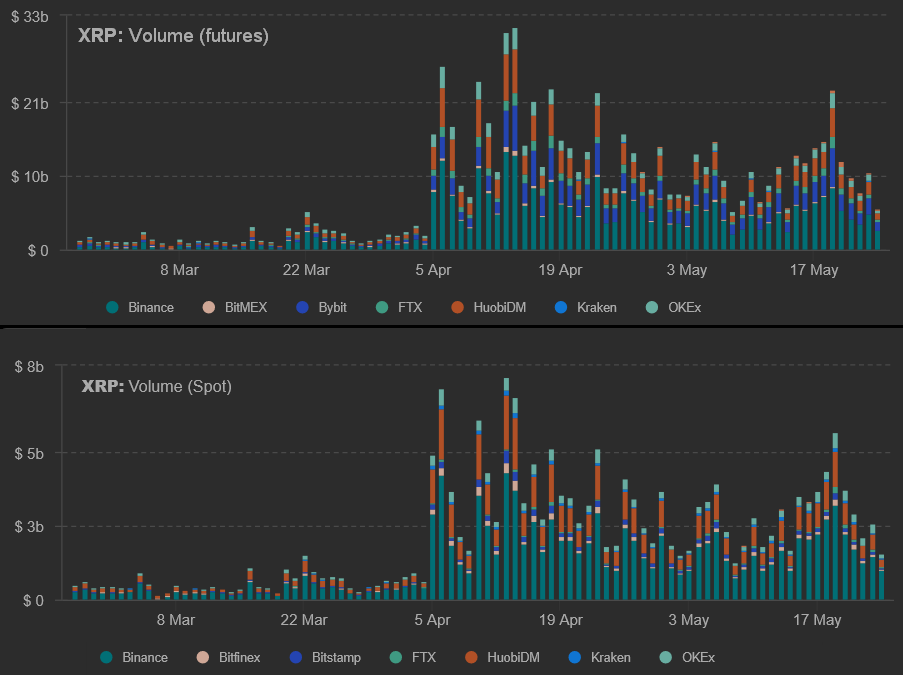

Volumes spiked in unison, which is healthy

The volume of futures markets provides a hint on whether some unusual phenomena took place. By comparing this data with regular XRP spot markets, there should be a clear correlation, and futures volumes must have grown considerably to sustain the $2.1 billion in open interest.

Although there was a significant spike on April 5, the movement was accompanied by regular spot exchange volumes. Moreover, the $10-billion daily turnover in futures markets is more than enough to sustain the $2.1 billion in open interest.

The futures premium reached unsustainable levels

To assess whether traders could have created an unusual open interest based on excessive optimism, one needs to analyze futures prices premium versus regular spot markets. The three-month futures should usually trade at a 1.2%–2.4% premium, or 8%–15% annualized.

Futures contract sellers are essentially postponing the trade, therefore, requiring more money to compensate. However, during extremely bullish markets, the premium can soar well above 3.8%, which is equivalent to 25% per year.

As depicted above, June contracts traded almost 10% above regular spot exchanges. That is nothing short of spectacular, as it represents a 75% annualized premium. However, these levels are completely unsustainable and transpire excessive leverage from buyers.

Cryptocurrency markets are highly volatile, and no one should bet that any event will not repeat itself. However, there is some indication that traders became so confident that they refused to reduce positions even if being paid 8% or 9% above market levels.

Markets tend to exaggerate in both directions

Therefore, there is reason to believe that the current $600-billion futures open interest and negative premium signal excessive fear and do not correctly reflect the market. XRP’s price has risen 294% in 2021, and the recent Ripple Labs news regarding the United States Securities and Exchange Commission lawsuit is somewhat encouraging.

Investors are not wrong to expect the futures open interest to recover the $1-billion mark as XRP holds above $0.80. However, it is unlikely that the markets will reach a 50% or higher annualized premium, let alone $2-billion open interest anytime soon. It usually takes some time for longs to regain confidence, which is healthy for another leg up.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.